Deducting From a Tenant's Deposit

The number one reason landlords get sued in small claims court is mishandling the security deposit.

In California, Civil Code §1950.5 governs every step of the process from timelines to documentation to how much you can deduct. If you’re navigating this on your own, one mistake can cost you the entire deposit or up to three times the amount in penalties. Here's how to do it right.

-

Step 1: Know the 21-Day Deadline

Once a tenant moves out and you regain possession of the property, you have 21 calendar days to:

- Return any unused portion of the security deposit

- Send a complete itemized statement of any deductions

This statement must include:

- Receipts for any work performed

- Contact information and address of any vendors used

- A breakdown of what each charge is for

If you miss the 21-day deadline, even by one day, the law says the tenant is entitled to a full refund of their deposit—regardless of the condition they left the property in. If the tenant sues you in small claims court, you could be liable for the full deposit plus up to three times that amount in damages and court costs.

-

Step 2: Comply with AB 2801 – Photos Are Now Required

As of April of 2025, AB 2801 added a new requirement: you must take and include photos with your deposit disposition.

You are now required to:

- Take photos immediately after move-out, before any cleaning or repairs are done

- Take photos immediately after all cleaning and repairs are complete

- Send these photos to the tenant along with the itemized statement and receipts

These photos serve as objective documentation and protect both you and the tenant from disputes. If you fail to include them, the deductions you claim could be disallowed in court.

-

Step 3: Provide Receipts and Contact Information for Vendors

If you hired anyone to clean, repair, or perform maintenance on the property, you must provide:

- A copy of each invoice

- The name, address, and contact info of each vendor

- A clear description of what service was performed

If you did the work yourself, you can still deduct for it—but only at a reasonable hourly rate. Be prepared to explain how you calculated that rate.

-

Step 4: Deduct Fairly and Within the Law

You can only deduct from the security deposit for:

- Unpaid rent

- Damage beyond ordinary wear and tear

- Cleaning needed to return the unit to its original condition (excluding normal use)

You cannot deduct for:

- Pre-existing damage

- Normal wear and tear (such as light scuffs on paint or worn carpet)

Be sure to reference your move-in and move-out inspections. These are essential to proving what damage occurred during the tenancy and what already existed beforehand. Without proper documentation, your deductions can be disputed or thrown out.

-

Step 6: Watch Out for Utility Debts That Stay with the Property

In most California cities, water and trash bills stay with the property, not the tenant. If the tenant leaves an unpaid balance, the utility provider will not allow you to start new service until the debt is paid. Always call the local water and sanitation companies before completing your deposit disposition to check for unpaid balances. Otherwise, you may refund the tenant and later find yourself paying their leftover bills out of pocket.

-

Step 7: Mail It, Track It, and Keep Proof

Even if the tenant doesn’t provide a forwarding address, you still need to mail the deposit accounting and any refund to the last known address, which is typically the rental property. If it gets returned, keep a copy of the unopened envelope. That shows you made a good faith effort to comply with the 21-day rule.

Tenants are often very aware of this deadline. Some will deliberately wait to contact you until after the 21 d

connect with a specialist

Owner or Renter?

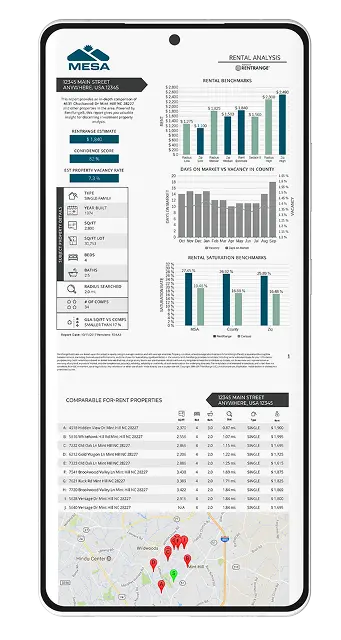

Discover Your Property’s maximum Earning Potential

You can maximize your rental income with our complimentary rental analysis. Our expert insights help you understand market trends, set competitive rates, and position your property for long term success.

What Sets MESA properties Apart?

Expertise and Reliability

At Mesa Properties, we make owning a rental property truly hands-off while keeping you informed every step of the way. From setting the right rent price to handling maintenance, tenant screening, and legal compliance, we take care of everything so you don’t have to. Our proactive approach minimizes vacancies, prevents costly issues, and ensures your property runs smoothly without your constant involvement. With full transparency and clear communication, you’ll always know what is happening with your investment. With Mesa, you can own rental property without it owning you.

Proven Process

At Mesa Properties, process isn’t just a buzzword, it’s in our DNA. Built on two generations of process-driven expertise, our systems create a high-quality experience for every owner and tenant. Steve and Sheryl Shwetz, with over 20 years of franchise management experience, laid the foundation, while Sam and Sawyer Shwetz bring technical experience from the US Navy and JPL to refine operations. This results in a proven, structured process that eliminates the guesswork, delivering reliable property management every time.

let’s chat. schedule a consultation to discuss your property goals.

Where are you located?

If you're looking for a personal rental, please call our office: 909.360.2660

what we do as your Inland Empire & High Desert Property Manager

real-time reviews from our owner & tenant clients

Frequently Asked Questions for Southern California Property Owners

-

How do I get started with property management in ?

Getting started is simple — schedule a quick consultation, and our team will review your goals, walk your property, and prepare your management agreement. We handle onboarding, marketing, photos, and listing setup so your rental is ready fast. -

How do you screen tenants to protect my property?

We use a comprehensive screening process that includes credit checks, income verification, rental history, background screening, and identity verification. This helps ensure responsible tenants who pay on time and care for your home. -

Are there any hidden fees in your property management plans?

No — all fees are fully transparent and disclosed upfront. Our pricing lists every cost clearly, and we never add hidden marketing charges, junk fees, or unexpected add-ons. -

How often will I hear from my property manager?

You’ll receive regular updates, immediate communication for urgent issues, and 24/7 access to your online owner portal for statements, documents, leases, and maintenance updates. -

How do you handle maintenance and repair requests?

We coordinate repairs using vetted, reliable vendors and track all work through our system. Tenants can submit requests online 24/7, and emergencies are handled immediately to protect your property. -

How long does it take to rent out a property in ?

Most well-priced, rent-ready homes in lease within a few weeks. Strong marketing, professional photos, and daily showings help reduce vacancy and maintain predictable cash flow. -

What happens if a tenant pays late or stops paying rent?

We follow a documented late-rent and legal compliance process that includes notices, communication, and enforcement of lease terms. If necessary, we coordinate the eviction process and work to minimize vacancy and financial loss. -

Are you licensed and familiar with local landlord-tenant laws?

Yes — is licensed, insured, and continuously updated on local, state, and federal rental laws. This protects you from compliance mistakes and costly legal issues. -

How do you support out-of-state or busy property owners?

Through proactive communication and 24/7 portal access, owners can monitor finances, approve large repairs, and view property details from anywhere. We manage the daily work so you stay informed without being overwhelmed. -

How do tenants request maintenance and how fast do you respond?

Tenants submit maintenance requests online or by phone, and we respond based on urgency. Emergency issues are prioritized immediately, ensuring safety and preventing property damage. -

How do I use the Rent vs Sell Calculator to decide what to do with my home?

The Rent vs Sell Calculator compares your rental income, expenses, equity growth, and future property value against what you would earn by selling today. Simply enter your home’s value, mortgage details, and rent estimate, and the tool instantly shows which option builds more long-term wealth. -

What does the ROI Calculator help me understand as an investor?

The ROI Calculator breaks down your expected rental returns — including cash flow, cap rate, cash-on-cash return, loan amortization, and appreciation. By entering your financing, expenses, and rent, you can quickly forecast how profitable a property may be over 1 to 30 years.