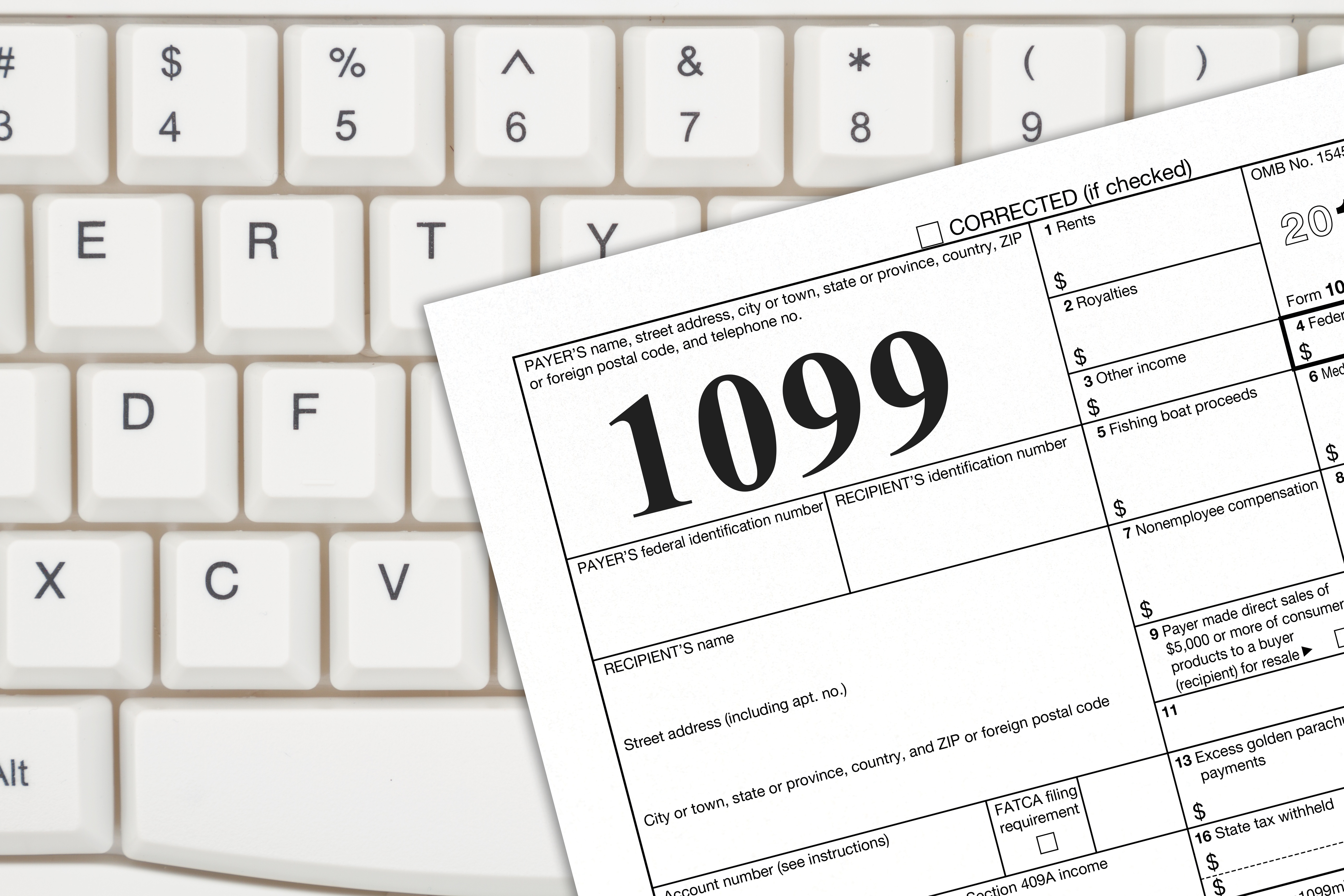

So you have rental property managed by a professional property management company and in comparing your 1099-MISC to your 12-Month Cash Flow report, you notice the total income on the Cash Flow Report does not match the 1099-Misc. Has your property manager made a mistake?

Maybe….but probably not.

The following three accounting anomalies can cause your 1099-MISC to NOT match your 12-month cash flow for the same period:

- Your Tenant Pays Rent Early. Your tenant pays rent early in December for a rent charge that covers January of the following year. This is caused by a 2013 IRS rule change that requires owners to report rental income in the year they receive it, NOT the year it is to be used. If your tenant paid their January rent in December of the prior year, it gets reported on your 1099-Misc in the year it was received, NOT the year it was applied to rent. To further complicate the accounting, assuming everything else stays constant the 1099-Misc income will be reduced by a similar amount in the following year and cause the 1099-Misc to 12-Month Cash Flow comparison to be off for another year. Keep this in mind for next year's tax season.

- You sign a new lease in December. Similar to the first scenario, if your lease starts in January but your future tenant pays all or a portion of the rent in December when they sign the lease agreement, this income is reported to the IRS in December NOT January of the year it is actually applied.

- You have to use the tenant's security deposit. You have a tenant that moves out and you use part or all of the security deposit to make needed repairs on the property. The amount of the security deposit that you use to make the repairs becomes income to you when it is used. This income would not be reflected on your 12-month cash flow report. Remember, the income is offset by the repair expenses so ultimately you are not taxed on security deposit monies used for tenant repairs as part of the move out process.

A good property management company will sit down with you and go over your specific situation and help you understand both your monthly Owner Statements and your year end accounting reports. So before you get too frustrated, just reach out to your property manager and ask for some clarification. Your tax accountant can also provide insight into what at times can be a very confusing explanation of discrepancies between a 12-month cash flow report and the income reported to the IRS via a 1099-Misc.